USD on the front foot, hawkish RBA hold expected

Headlines

* Dollar advances on higher yields, downbeat market mood

* Gold retreats from record high as Fed pivot bets may be overdone

* RBA set for hawkish hold as global inflation pressures abate

* Nvidia insiders unload shares after 220% AI rally

FX: USD’s rebound from its lows last Wednesday continued after three straight weeks of losses. Prices have bumped into the 200-day SMA at 103.57. The midpoint of the summer rally sits below at 103.46. Firmer yields and softer stocks helped the greenback after Fed Chair Powell’s modest pushback to rate cut pricing on Friday.

EUR fell for the fourth day in a row, but the downside was capped by the 200-day SMA at 1.0820. The euro lagged badly last week with some key crosses – EURCHF, EURAUD and EURGBP – suffering.

GBP couldn’t beat resistance at 1.2720. That’s the 61.8% Fib level of the summer decline. There’s little UK data so sterling will be driven by external factors like USD and risk sentiment. Support is the 50% retracement at 1.2589.

USD/JPY dropped to a fresh cycle low at 146.22 before closing above 147. Support below is a minor long-term Fib level at 146.08. The 10-year US Treasury yield recovered slightly above 4.25%. That comes after it dipped to a multi-week low at 4.19%. Rates had touched above 5% in late October.

AUD slipped after making a new swing high at 0.6690. Support sits at the 50% mark of the summer drop at 0.6584, plus the 200-day SMA at 0.6578. Traders await the RBA meeting. No changes are expected with a hawkish hold anticipated.

Stocks: US equities were mixed with gain in small caps offset by losses in the S&P 500 and Nasdaq. Most of the weakness came around the open with some losses being pared through the day. The S&P 500 lost 0.54% to settle at 4569. The tech-heavy Nasdaq 100 finished 0.99% lower at 15,839. The Dow edged 0.11% lower to close at 36,204. Real estate led the gains with healthcare.

Asian futures are in the red. APAC stocks traded mixed on Monday after starting positively from Wall Street’s decent close. The ASX 200 was higher with gold miners boosted by the precious metal’s surge in the early hours of Monday trading.

Gold retreated from a record high at $2148 hit in Asian hours. Powell’s weak pushback to the dovish repricing of Fed rate cut bets on Friday was the major reason for the spike higher. The precious metal eventually finished down over 2% and not far off the lows at $2020. Stronger yields and dollar hurt gold as rate cut pricing was reined in. The chances of a March cut receded to around 60% from 75%.

Day Ahead – RBA and ISM Services

The RBA is nailed on to leave rates unchanged at 4.35%. This comes after it hiked rates by 25bp at its last meeting. The bank’s quarterly SOMP remained relatively hawkish as it acknowledged recent data had been stronger than expected. It also said inflation remains high and is forecast to decline more gradually than anticipated. Governor Bullock has reaffirmed this hawkish bias in recent weeks so any change from this stance will hurt AUD.

The November non-manufacturing US ISM Services is forecast to tick higher to 52.5 from 51.8. The sector had slowed for a second straight month in October to a five-month low. A reading above 50 indicates growth in services, which account for over two-thirds of the economy.

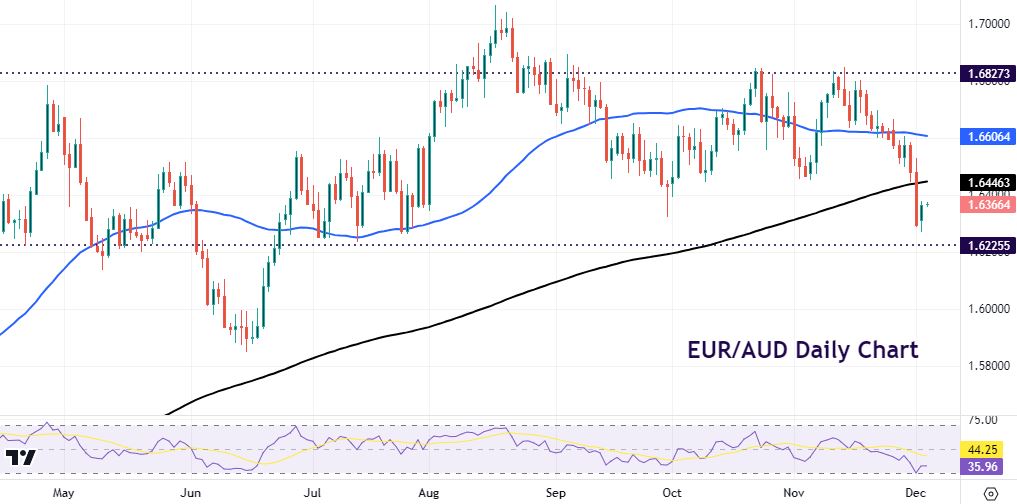

Chart of the Day – EUR/AUD drops down out of recent trading range

The euro suffered last week as softer than expected inflation data saw rate cut bets brought forward to springtime next year. Comments from an ECB official also hurt the single currency as he said rate hikes are now over. Markets added 13bps to ECB rate cut expectations and 127bps in total for 2024.

In contrast, the RBA is expected to retain its hawkish bias even though the monthly CPI was soft. The bank probably will pay more attention to the quarterly data which is next released at the end of January. The 200-day SMA and Friday’s breakdown point is at 1.6446. Support sits around 1.6225/35.